If you are an entrepreneur or a business owner, you’ve likely got your hands full, You might be acting as the CEO, CTO, lead salesperson, you name it – all while trying to juggle daily business operations and get a product launched. With so much responsibility, it might seem like there is no time to keep track of your company’s finances on top of everything else.Everybody knows how difficult running a business is, and we are also well aware of the brutal make-or-break market that exists when starting a company. Statistics can be found all over the internet that scare people with genuinely good ideas away from starting a business.

What people don’t realize is how often a business’s failure is directly related to the mismanagement of their finances. Whether it be bookkeeping/accounting, formulating a sound financial plan, or building monthly budgets – some businesses simply choose to ignore their finances almost entirely.

Often a business’s failure is directly related to the mismanagement of their finances

Financial errors are all too common, and just as easily avoidable. Let’s touch on some of the most common financial mistakes we see businesses make so that they don’t also happen to you.

1. Unexpected/Hidden Expenses

Startups tend to significantly underestimate the costs of running a small business. Given, some do develop a budget that they believe will allow them ample room for extra spending. However, there are certain “hidden costs” that businesses all too often fail to anticipate until it’s too late.

You have business insurance, permits/licenses, not to mention you will have to start paying for employee benefits once you begin growing and need to hire additional personnel. And let’s not forget about the dreaded T-word that small businesses always forget about – taxes.

Expenses like these should never have to come as a surprise, yet somehow they do time and time again. So be sure to do your research, and understand the unexpected costs that might be relevant to your business.

Check Out these Awesome Resources:

2. Overspending on Sales

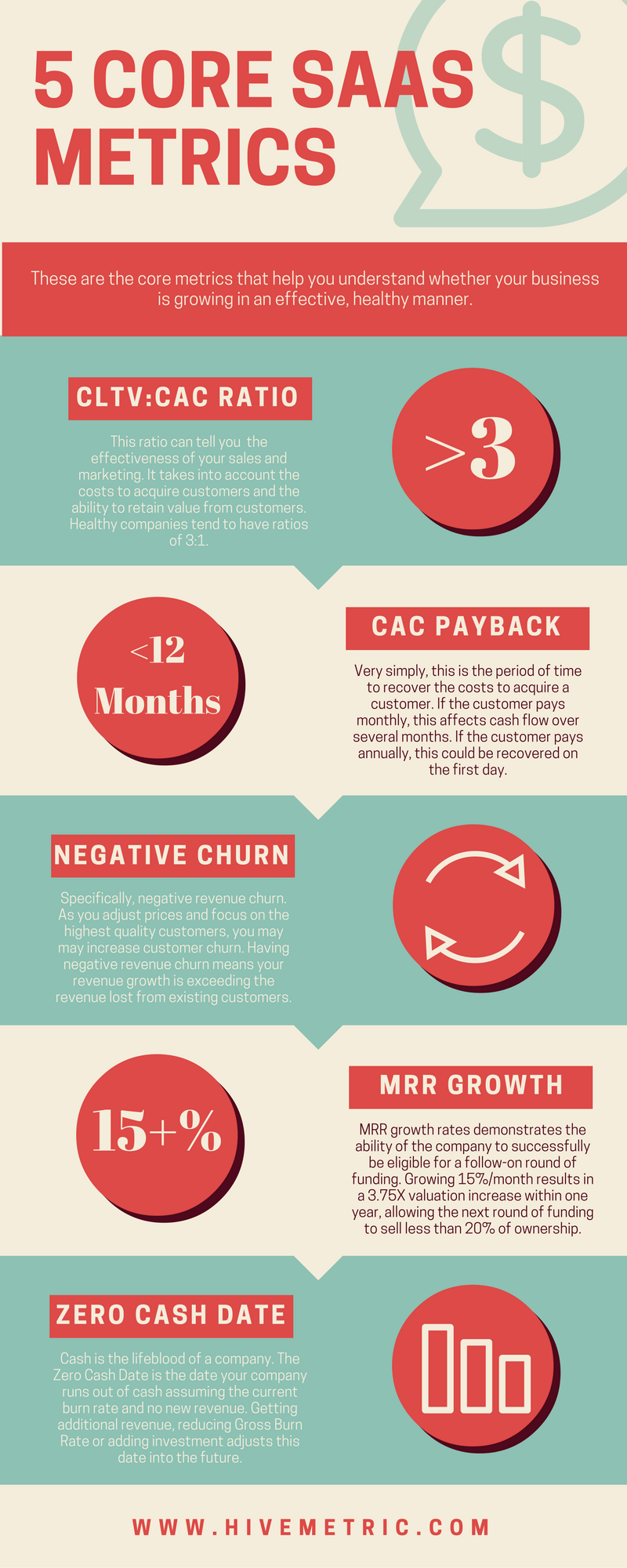

One common misconception that tons of businesses maintain is higher sales activity always yields higher profits. While increased sales activity most certainly has the ability to produce greater profitability, businesses must be aware of a few key metrics to ensure they are optimizing their sales spending:

- Customer Acquisition Cost (CAC) – the average amount spent on sales/marketing per gaining one additional customer.

- Customer Lifetime Value (CLTV) – the total revenue a customer yields a company over their customer lifespan

As VC investor & SaaS expert/entrepreneur David Skok puts it, a business’s CLTV must be higher than its CAC in order to justify allocating any more spending towards sales.

In essence, the amount of revenue the customer will produce over their full duration as a customer should be higher than the average amount spent in acquiring them. This way, businesses can always verify that there will be a net-positive effect on profits for every dollar spent on sales.

Also be sure to check out more on aligning your sales strategy with your revenue forecast

3. Cash Flow Mismanagement

One of the largest killers to businesses of all sizes is being unaware and oblivious to their cash flows. In fact, 82% of business failures are due to poor cash management.

On top of this, a CB Insights study found running out of cash to be the second leading cause for startup failure. With statistics like these, you have to wonder why businesses don’t spend more time analyzing their cash flows?

82% of business failures are due to poor cash management

One routine mixup that we see is the thought that lofty revenues and large profits must mean a business has sufficient cash. However, just because a company looks good on paper does not automatically mean they are healthy from a cash standpoint.

For example, say customers/clients take a long time to pay, or you constantly have an excessive accounts receivable balance. Your profits might look great, but chances are the actual underlying issue for why your business is struggling lies in your cash flows.

4. Excessive Overhead Costs

That fancy new company car and penthouse office space might be real tempting, but it’s likely a business would be able to operate just fine without them.

These examples might be a bit of an exaggeration, but more often than not companies can easily pinpoint a few costs that they might be better off without. Whether it be lowering excessive rent/utilities expenses or eliminating unnecessary subscriptions, there are always opportunities to run leaner.

Developing a simple budget can do wonders for helping you visualize the overhead expenses your business actually needs to operate at full capacity.

5. No Financial Model/Plan

Financial models are a cornerstone to planning your financial needs and executing your business plan successfully.

They are absolutely essential when you are trying to gain funding from investors. However, many businesses also underestimate the impact that they have internally for setting financial goals and developing a strategic company budget.

What should you start thinking about when developing your financial model? Read More…

Not only this, but a well thought-out financial forecast can also help you clarify your revenue model, potential future cash needs, and aid in addressing the 4 other financial mistakes we discussed in this article.

For anyone who reads our posts regularly, you know that the crew at Hivemetric hates spreadsheet-based financial models – which is why we are creating a dynamic financial modeling tool that integrates with the other applications and tools you use to run your business. We want you to use our platform to make intelligent financial business decisions and forecasts that evolve and grow the same way that your business does. Stay tuned, our launch is coming soon!