Creating a financial model for your business can seem like a daunting task. Because of this, most businesses hold off until the last minute to build one – this should never have to be the case. Let’s go over some of the main pieces in a financial model so that you can design yours with confidence.It is no mystery that if your business is going to require funding to operate, your investors are going to want to see a financial model. Investors need detailed insight into how you plan on running your business from a financial perspective, and you need to be able to convince them that you can do so in an effective and responsible manner.

Many businesses use simple spreadsheet templates downloaded off the internet to construct their financial forecast (we DO NOT recommend doing this). While this might give a business somewhere to start, they are often clueless when it comes time to explain the countless details and various components to the model they just set up.

It breaks our hearts when we hear about another company losing investment due to poor presentation and the inability to interpret their financial plan. No business deserves this tragic fate – which is why we are going to break down how you need to approach some of your financial model’s most important pieces so you don’t end up being just another startup sob-story.

Back Your Revenues With Killer Assumptions

You, Me, Investors, Board Members – everyone loves seeing huge revenue projections. Tons of businesses think that if they just fill in their revenue forecast for the next few years with a few astronomical digits, investors will be practically throwing funding at them. Afterall, who in their right mind could ever pass up 50% top-line revenue growth MoM for the next 5 years!?

What these businesses typically lack is the ability to explain how they arrived at their monstrous projections. Every dollar of revenue is comprised of multiple variables, commonly a customer and the amount which that customer paid for your product. These variables are your assumptions, and they are the guts of how your business will ultimately derive its revenues. Therefore, if your business is expecting to grow revenues at a high rate, you need to be able to explain how your assumptions are going to change in order to achieve such growth.

Let’s say you have decided that your revenue growth is going to be backed by the assumption that your business will be rapidly growing its customer base. You should be able to show how you plan on acquiring those new customers. Are you going to dish out a new marketing campaign? Or perhaps you are planning on using an aggressive sales strategy?

See how to Connect Your Sales Pipeline to Your Revenue Forecast

Either way, the revenue forecast in your financial model is much more than a number and a growth rate. If you can prove to investors that you understand the inputs and assumptions that drive your revenue projections, your financial model will be vastly improved.

Be Honest With Your Expenses and Prove Their Purpose

It is all too common for both early-stage and mature businesses to underestimate the costs they will incur in the future. This is even a surprisingly frequent occurrence for larger businesses as well, considering they have more historical data to base their cost assumptions on. However, time and time again expenses are undershot, causing profits to come in lower than expected, which turns investors into unhappy campers.

The simple cure to this problem is to be honest when it comes to projecting your expenses. Yes, we know that you want to make your future profits look as attractive as possible. But nothing is uglier than having to explain to your board how you missed the prior quarter’s projections because you spent twice as much as you initially anticipated.

This does not mean you should go about forecasting higher costs all throughout your financial model. Your investors are still going to want answers for why you are burning through all of their money like there is no tomorrow. Additionally, this is why it is highly important that you are able to explain the specific purpose of all your expenses. If you can prove that an investor’s capital is going to be used towards something constructive for your business that will result in a positive impact and increased revenue, they will be much more understanding of your lofty expense forecast.

In sum, be straightforward with your cost estimates. Add in a well-justified reasoning for each expense projection and your financial model will become much easier to portray and tremendously easier for investors to swallow.

Also, in the case of some startups, it can even be easier to forecast your expenses before you ever touch your revenues!

Wrap It All Up With Outstanding Metrics

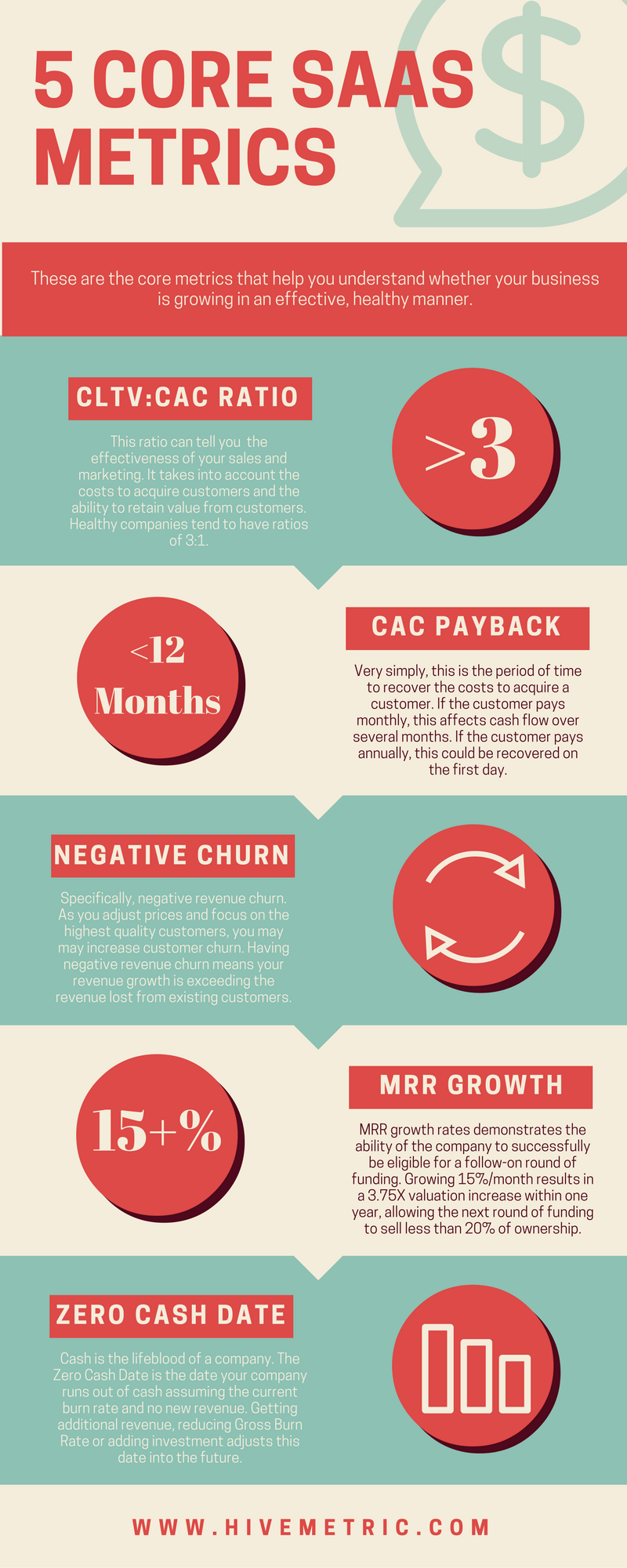

Nothing in a financial model gives a clearer snapshot of your business than your metrics. Your company’s metrics are all based on the data which you have already laid out in your financial model, so if something is off that you did not catch in your initial projections and data, it will surely pop up in your metrics.

Your metrics can give you an idea for the areas of your business which you want to target your attention on most when developing your financial model. Say your Customer Acquisition Cost (CAC) is larger than you would like – so you decide you need to focus on making your sales and marketing processes more effective and efficient. Or maybe your Churn Rate comes in surprisingly high – indicating you should devote more time to retaining your existing customer base.

Metrics can provide insights into your business that might not be apparent by simply looking at your revenue and expense numbers. Once you have laid out all of your company’s most important metrics, you will have a much clearer picture as to the direction you want to take your financial model.

Be sure to check out these awesome resources on Startup Metrics:

The 10 Most Important Metrics In A Startup’s Financial Statements

… And Let Hivemetric Help You Do It!

At Hivemetric, it is our goal to make your financial model less intimidating – instead transforming it into an exciting component of your business you can look forward to. We know how spreadsheets can be frustrating and discouraging when it comes to projecting your financial future. It is our vision to remove the need for spreadsheets from your forecast. We want you to be able to forecast your revenues with clear-cut underlying assumptions, budget your expenses while connecting them to future revenue generation, and tie everything together in an all-inclusive dashboard of well-defined metrics. Your financial model should not have to be used only for investor presentation, but also as a dynamic tool capable of growing alongside your business.