Unless you are making money straight out the gate, your startup is going to need money to operate. Like gasoline to an engine, funding is the fuel that propels startups from an idea to a growing and scalable business.

While I’m sure you’ve heard the rumors for years of how startup creation has been on the downturn, funding and investment into startups still remains at an impressive level. Sure, the number of deals might be slowly decreasing, but the total dollar value of those deals remains near historic amounts.

Regardless of whether you think your startup or idea needs funding right now, at some point down the road, I’d be willing to bet you will.

So to prepare for that time, I’ve thrown together a list of some of your options for when that time arrives.

1. Bootstrapping

![]() Not necessarily a form of outside funding, but bootstrapping is definitely worth mentioning. Plus everyone loves a good story of a business who bootstrapped their way from ground zero to greatness.

Not necessarily a form of outside funding, but bootstrapping is definitely worth mentioning. Plus everyone loves a good story of a business who bootstrapped their way from ground zero to greatness.

Bootstrapping is essentially digging into your own savings, operating as lean as humanly possible, and grinding it out until you can start making money or raise at a higher valuation than you would be able to currently.

It’s great for not having to give up any control or portion of your company and you are forced to operate your startup at high velocity, but obviously, your runway is about as far as your savings can take you.

2. Debt/Loans

![]() Loans can be a great way to get your business off the ground, however not without limitations.

Loans can be a great way to get your business off the ground, however not without limitations.

You save yourself from giving up your company, however it is also important to not overlook the consequences of how quickly interest payments can rack up.

Friends and family members can be a great source of funding to get your startup off of the ground. Reach out to loved ones and those who care about you most – the people who truly believe in you and your ideas are the ones who you want on your side early on.

For a more formalized loan, the US Small Business Administration offers a variety of loans for small businesses and startups who are in need of some initial funding.

3. Crowdfunding

![]() Crowdfunding used to be a new and somewhat unclear topic, however times sure have changed now that startup crowdfunding is on track to surpass venture capital investment.

Crowdfunding used to be a new and somewhat unclear topic, however times sure have changed now that startup crowdfunding is on track to surpass venture capital investment.

There are three basic types to raising money through crowdfunding:

- Early Access – where you accept money in the promise of delivering your product first to those who donated to your business

- Debt – basically just taking a loan from a large pool of people

- Equity – giving up a portion of your business for a sum of cash that was pooled together by a large group of people

Crowdfunding has quickly become a popular and viable method of funding an idea or startup. There are tons of crowdfunding sites out there, and more that emerge every single day.

4. Business Grants

![]() Startup and small business grants are kind of like the holy grail of startup funding. You don’t need to repay them or give up a portion of your company – the only limitation is that they can be fairly specific about what the funds can be used for.

Startup and small business grants are kind of like the holy grail of startup funding. You don’t need to repay them or give up a portion of your company – the only limitation is that they can be fairly specific about what the funds can be used for.

While they can be difficult to qualify for, there are a decent amount of grants available – and they are offered through a variety of institutions and local/federal governments.

Be sure to do some poking around to find if there are any grants that might be a good fit for your business.

5. Accelerators & Incubators

![]() Startup accelerators & incubator programs have been popping up like wildfire over the last decade, and are extremely helpful in developing an idea into a scaling business.

Startup accelerators & incubator programs have been popping up like wildfire over the last decade, and are extremely helpful in developing an idea into a scaling business.

What many people do not realize is that some of these programs also offer seed funding or a small cash injection to get your business off the ground.

Typically ran in a series of cohorts throughout the year, accelerators are constantly taking applications, so be sure to apply to as many as you can!

6. Angels

![]() Angel investors are typically high net worth individuals who invest their own money in very early-stage companies in exchange for a portion of ownership.

Angel investors are typically high net worth individuals who invest their own money in very early-stage companies in exchange for a portion of ownership.

From friends and family to individual angels, many startup communities all over the country, large or small, have an accredited group of Angel investors that are always in search of the next big idea to inject some cash into.

7. Venture Capital

![]() Finally, we have venture capital. VC investment might not be the first source of funding that your business takes, but at some point you are going to likely need to look to VCs to push your company to the next level.

Finally, we have venture capital. VC investment might not be the first source of funding that your business takes, but at some point you are going to likely need to look to VCs to push your company to the next level.

VC investment has been red hot over the last few years, and while it will be difficult to sustain those same levels of insane growth, it doesn’t appear VC fundraising will be slowing anytime soon.

The main difference between Angels and VCs, aside from the average investment size, is that Angels typically invest out of pocket, where VCs are investing on behalf of their company, where the invested funds usually come from a group of investors, institutions, corporations, etc.

Paul Graham’s timeless guide to startup funding is an amazing resource. He walks a hypothetical startup through every stage of venture capital funding, explaining every little detail along the way.

Bonus: ICOs

You may have overheard some of the recent hype surrounding Initial Coin Offerings.

ICOs work somewhat similarly to crowdfunding, but use cryptocurrency instead of dollars. While I claim to be no expert in the field, companies have been raising absurd amounts of money in the form of company tokens backed by cryptocurrencies.

By no means am I condoning an ICO for your business, just might be something you find interesting in learning more about, especially if your company’s activities are involved in blockchain technology.

Final Thoughts

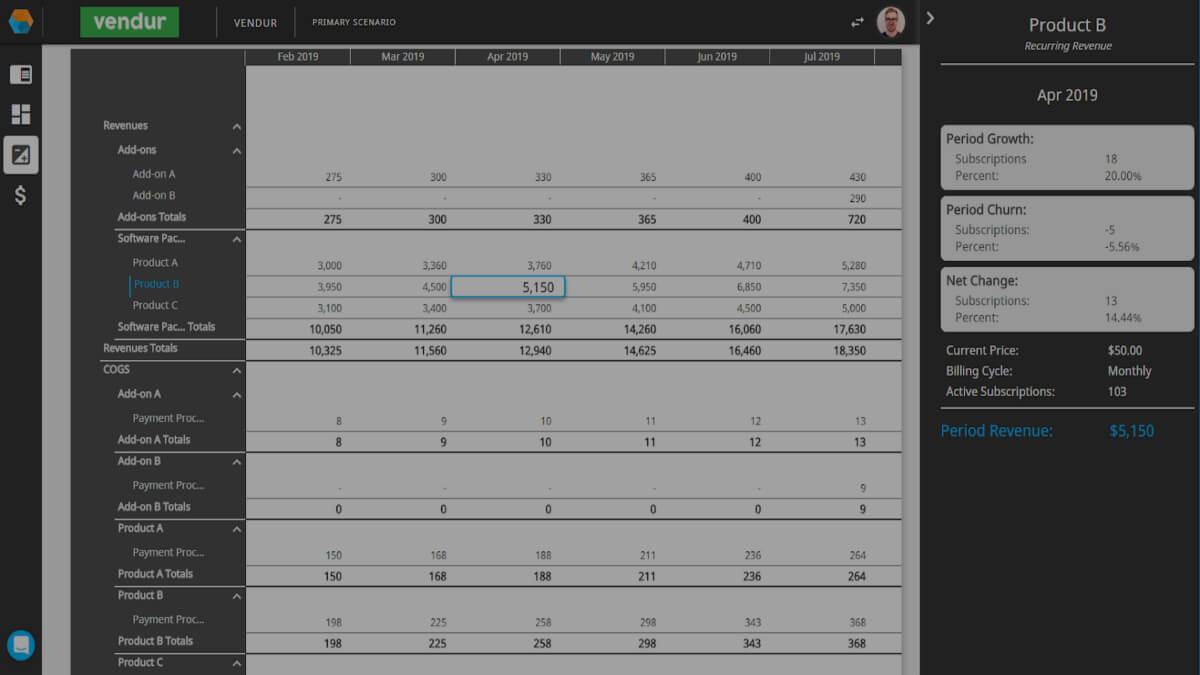

Regardless of the type of funding you are going to pursue for your startup, it is important to have a financial model or financial plan in place.

You can’t drive a car with your eyes closed (or at least it’s not recommended). Similarly, anyone entrusting you with their funds is going to want to be sure that you know exactly what you are going to do with their cash.

And remember, startup funding is an amazing game, and incredibly satisfying once that funding has been secured – however, there is such a thing as raising too much money and raising irresponsibly.

So, do your research, and always keep in mind it’s not about how much you raise – it’s about the quality of the investment – who it’s coming from, the terms by which it is made, and how you plan to use it.

Now go and get yourself funded!