When you’re a startup, you have a lot to worry about.

How are you going to get more customers? Close that new deal? Build that latest feature? Grow your team?

There are a million different questions startups need to be asking themselves – the list goes on and on.

All of these questions are essential to starting, growing, and scaling your business. I asked myself the exact same things when Hivemetric first started out, and I still revisit many of them to this day.

But all too often I see founders never asking themselves one of the most important questions of all.

That question is “Will my business have enough money to survive?”

It’s the one question that has 100% to do with if your business lives or dies. And with the second leading cause of startup failure being running out of cash, it’s surprising so many companies completely ignore the issue!

I don’t want your business to run into the same cash flow issues that plague over 4/5 of startup failures.

So I threw together a few questions to think about so you can avoid the same fate.

Where will the money come from?

Hate to say it, but money doesn’t just grow on trees.

The first thing to ask yourself as a business owner, is where your funds are going to come from.

There are generally two main sources: Earnings or Investment.

Earnings

If your business is making enough money to sustain itself right out of the gates, my hat is off to you. I’m jealous.

You’re turning a profit early on, effectively managing costs, operating smoothly – you’ve already got a fully functional business.

But one of the big questions startups need to ask when they find themselves in this position is “Can I grow my business the way I want with retained earnings, or do I need more money to take this biz to the next level?”

If you’re fine cruising along on your own funds, then by all means, keep chugging – in fact there are plenty of startups who get started without accepting funding at first.

But most startups aren’t in this same boat. While making money is nice, sometimes it takes a little extra push to really take off.

Enter: Investment.

Investment

Taking early-stage investment from friends/family, an accredited investor, or a lender is likely the most common method for an early stage business to get up and running.

Sure, you might have to give up a chunk of your company or pay a little interest on a loan.

But if it can significantly accelerate your growth, it is easily worth it.

And sometimes, you can even get outside investment from non-dilutive funding sources (the holy grail).

However, regardless of the source, the most important thing to do before taking any outside investment is to be as prepared as possible. This means doing your research, gathering all necessary materials, and walking into that investor meeting confident and ready.

Check out our list of the different types of startup funding if you are interested in the variety of sources your investment could come from.

How much money do I need?

As much as possible! Right?

Whoa there. Let’s take a few steps back now.

It might seem like an easy question, but determining how much you need is actually much more complex in nature.

And while it might be tempting to take as much money as possible for your startup, raising too much money can lead to serious consequences.

So make sure you don’t just lunge at the highest price tag – it’s important to calculate it out and give some thought to your exact cash needs.

One of the easiest ways to do it is to identify how much money you will need to get to your next round of funding – or the next point in time you will need more money (Tomasz Tunguz has a great piece on this).

You might be thinking “But how do I know when that will be?”

Well, you don’t. At least, not with 100% accuracy.

However, you can use a well crafted budget and financial forecast to predict when that time will come.

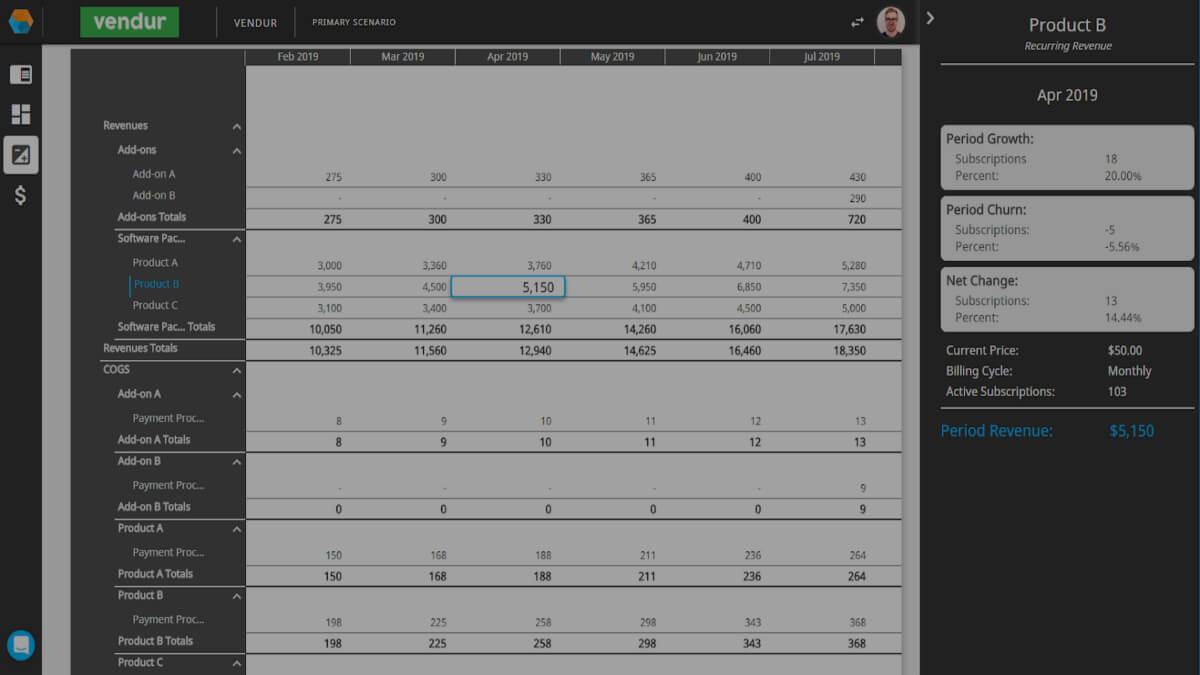

A detailed financial model can help you pinpoint your business’s runway and exact cash needs when for when that runway runs out. They help you test different assumptions, scenarios, and funding amounts – that way you can identify the exact amount that is right for you.

And, it turns out they aren’t even that hard to make.

Where can I save money?

This one might come as obvious, but I see way too many founders spending money month after month on things they barely use.

Here’s a story – I have a buddy with a startup who signed his company up for an insane 90% discount on this software for just $5/mo for the first 3 months.

He didn’t even really need this particular app, but for just $5 bucks, why not?

Well, month 4 comes around and all of a sudden that price jumps up to $49/mo.

But he had forgot he ever signed up. And he never checked his business bank account.

So he started paying that $49/mo.

Nearly a year later, he was reconciling his account (finally), and he realized he had paid nearly $500 for an app he never used!

The crazy thing is this happens all the time.

I see it all over the place in the startup world, and it kills me.

Every business has somewhere they can cut costs. While it might only be a few bucks here and there, it’s an important habit to get into and can save you a lot of time and money down the road.

All it takes is setting up a business budget, and then a few minutes at the end of each month to monitor and adjust that budget.

Moral of the story: don’t be like my friend.

——

Spend a little time thinking about how you would answer the 3 questions startups need from this post, and I guarantee you will increase your company’s chance of survival.

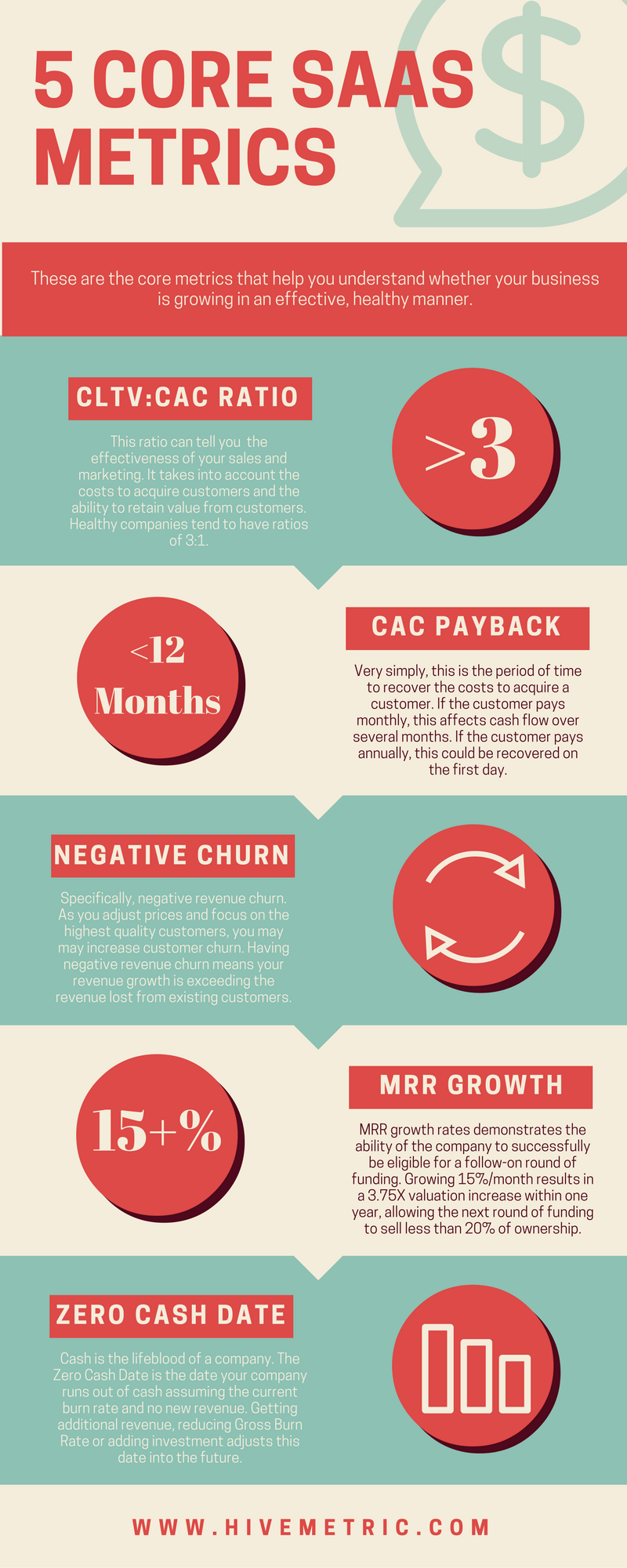

Whether you are preparing to raise funding or not, it’s important to know where your business stands financially, and what you can do to set your company up for greater financial success.

From identifying long-term cash needs, to monitoring day to day expenses, you will be happy your company is prepared for when it might need more money.

Cause nobody likes running out of money.

And if you’re like me and hate using spreadsheets to try to manage your finances, you should give Hivemetric a try – it’s free to start and literally takes 10 seconds to sign up!