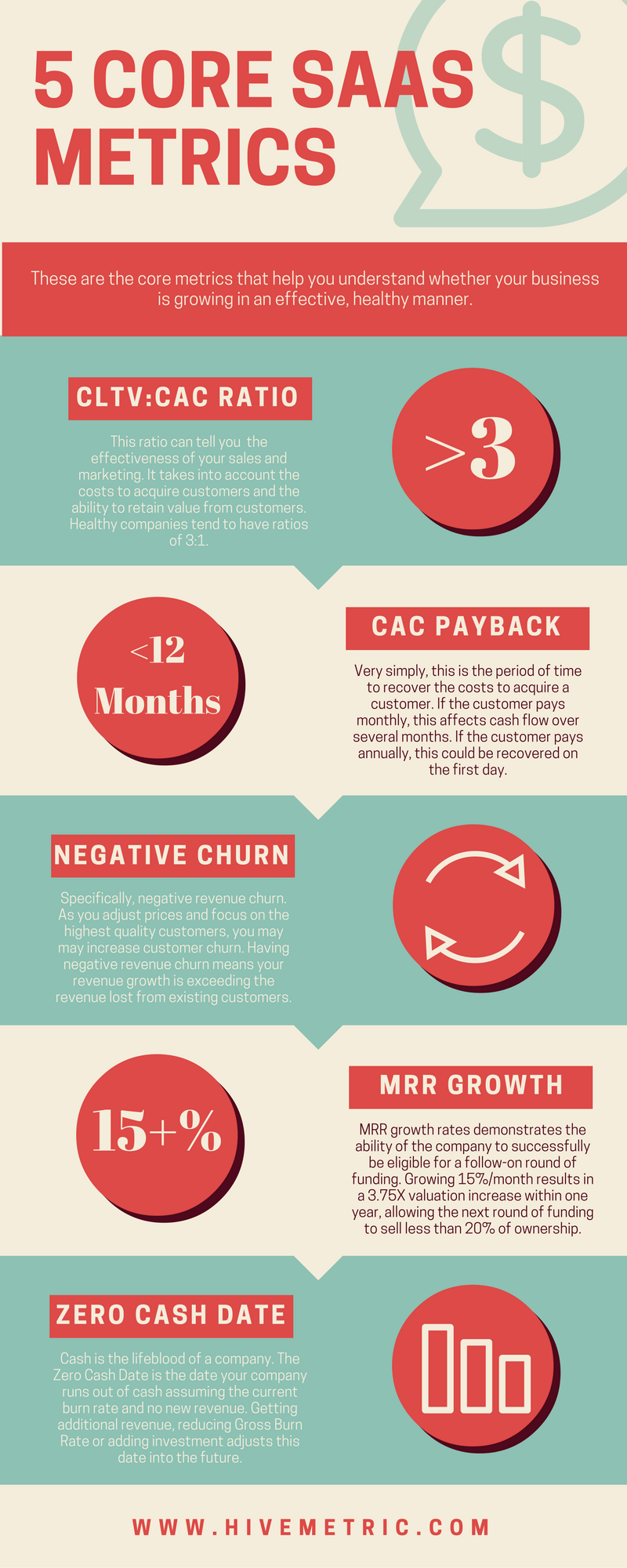

UNDERSTANDING THE CORE METRICS FOR SAAS COMPANIES

Put simply, there are really three core goals in running a company:

- Attract Customers

- Retain customers

- Monetize Customers

As a company, how do you measure and predict whether you are achieving these goals? How do you communicate to your investors and stakeholders the metrics and key performance indicators (KPIs) they need to understand to compare you against your competition?

Your metrics should tell you how long you expect to retain each customer you attract, how much it costs to attract each customer, whether the value of each customer compared with the cost of gaining that customer is sustainable, and overall whether your business model is working. In order to optimize your business spending and get a snapshot of the health of your company, you should consider creating a dashboard to track the following metrics.

LEARN HOW TO CALCULATE THESE METRICS:

- Monthly/Annual Recurring Revenue – (Christoph Janz breaks down Key Revenue Metrics)

- MRR Growth Rate – (Tomasz Tunguz article is a must read)

- Average Revenue Per Customer – (Lighter Capital explains ARPC)

- CAC Payback/CAC Recovery Period – (Mark Suster describes why the CAC Payback Period is so important)

- Customer Acquisition Cost – (Don’t kill your startup with too high CAC)

- LTV:CAC Ratio – (Dave Kellogg explains why this is the “Ultimate SaaS Metric”)

- Churn Rate (Customer Churn Rate/Revenue Churn Rate) – (David Skok demystifies churn and shows how to minimize it)

- Customer Lifetime Value – (See how David Skok incorporates DCF analysis into his LTV calculation)

- Annualized Run Rate – (Fast track your business to $1M ARR)

- Zero Cash Date – (Don’t die! Use your Zero Cash Date to create alignment, Jason Lemkin)

Also, check out the great work and information provided by David Skok at Matrix Partners.